International Institute for Private Equity and Investment Banking |

|

|

Private Equity vs Investment Banking Models

We are planning on becoming the leading global provider of research and education solutions to the Private Equity and the Investment Banking community. Private Equity is essentially about buying, changing and selling companies. The time of private equity professionals is divided between four main categories:Raising Money, Sourcing and Making Investments, Managing Investments and Selling off Companies. Essentially, every 4-5 years or so, the senior management will go knocking on doors of international investors such as pension funds, banks, insurance companies and high net worth individuals to raise money for their next fund so that they utilize their expertise, strategies and experience to make money for themselves and for their investors. Fundraising involves presenting the past performance of the fund, its strategy, and the individuals working in the firm that will be in charge of making investments. Investments are typically kept for 3 to 5 years, and after that time period they will be sold off, and that is really the time when the returns are generated. Investment banking is an advisory/capital raising service that advises clients on transactions like mergers and acquisitions, restructuring, as well as facilitating capital-raising. Investment Banking services of Raising Capital & Security Underwriting and Mergers & Acquisitions are very important to Private Equity and to PE investors in general. Both investors and advisors are of critical importance in structuring our world and shaping our society and the companies that represent it. It is our goal to help our clients reach and exceed their financial, business and life related targets with an innovative, results-driven educational experience and access to state of the art research. |

The role of the International Institute of Private Equity and Investment Banking is to help the international Private Equity and the Investment Banking communities develop strategies that are of great benefit to the industry, to their profit margins and to the world in general. We are also focused on helping the people and the leaders in the industry develop their talents and their craft for a better tomorrow.

| |

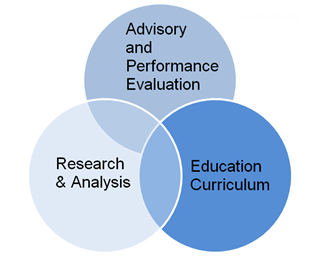

Research, Advisory and Educational Focus of PEIB

|

Advisory and Performance Evaluation

The Advisory and Performance Evaluation functions are and must remain core and integral parts of private equity and of the investment industry in general. Financial and Investment strategies and plans and the related products and services have become increasingly complex and competitive and it is nearly impossible for an average investor to compare and to evaluate fund performance and the new varying risks and potential returns of old and new strategies of various funds in the ever changing political and economic environments.

- Helping Investment Banks to structure their offerings, products and services around the needs of their clients

- Helping Private Equity Firms hone their strategies to address the needs of their investors and of the ever changing investment, debt and capital market conditions

- Helping investors and money managers choose the right private equity funds or pe fund combination and investment bank service providers that is right for them to help them meet their needs and goals

- Helping investors evaluate the funds and the strategies they are already involved in

- Specific focus on bank-affiliated private equity groups

- The Investments team works closely with sell side and buy side clients across developed and emerging markets.

- In a marketplace dominated by personal contacts and personal knowledge our staff's background serving as faculty at top international business schools to serving in senior levels of management across some of the largest firms in the industry is of great importance.

- We also are able to make introductions and to connect clients with advisors as advisory generates considerable revenue and has developed into a competitive and popular field for financial professionals.

|

Educational Curriculum

Ours is a unique program that provides a comprehensive induction, provides an annual refresher, and focuses on selecting and introducing high value recently developed approaches and tools to the private equity and the investment banking businesses.

- provides participants with essential and advanced technical knowledge and relevant soft skills

- introduction and advanced access to proven and state of the art private equity concepts and research, the rationale for investing in private equity and private equity funds versus direct investing and the role that investment banking plays in private equity

- real case study based learning approach will show the value chain, differences and commonalities in typical deals taking into account and explaining both successes and failures

- both private equity investor and advisory investment banking skills are covered in detail

- modular structure provides flexibility for working professionals while meeting their training needs

- Successful participants will be awarded Statements of Attainment (SOAs) and Executive Education Certificates

|

Research and Analysis

The private equity industry faces an intensely competitive deal-making environment worldwide, an overhang of aging assets waiting to be sold and challenging fundraising conditions. We take a holistic approach in our research and analysis that combines personal knowledge of the industry with proven and new state of the art research methods developed both in house and by our partner researchers. The PE and the IB industries both face new challenges and opportunities and it is our job to help industry players and their investors make the most of these opportunities.

- Both Private Equity and Investment Banking industries impact on the world economy and on the lives of direct and indirect investors are significant. Most people do not realize that pension funds have a significant exposure to private equity thus exposing the people with stakes in those pension funds.

- Annual investment banking advisory fees in 2010 alone were $84 billion dollars and the industry overall is crucial to our economy.

- LP's have a desperate hunger for yield that will help boost their overall portfolio returns at a time when bond yields have been at historic lows.

- Average allocations to Private Equity among all US public pension funds has been over 8% to 10%, a significant allocation indeed.

- Globally, GPs raised $88 billion just in buyout capital alone in 2012 and are set to double that. It is of crucial importance to develop new strategies to help them allocate that funding properly and in the best way for their investors and for the need of the market in general.

| |

|

|

One of the most successful investors of our time, Warren Buffett, through his investment vehicle

Berkshire Hathaway, has achieved compounded annual gains of 22.2 percent over

the last 40+ years. It is our great honor to announce the launching of the newest International Institute for Private Equity and Investment Banking research and educational initiative: The Warren Buffet Center of

Excellence in Undervalued High Performance Company Investing. One of the most successful investors of our time, Warren Buffett, through his investment vehicle

Berkshire Hathaway, has achieved compounded annual gains of 22.2 percent over

the last 40+ years. It is our great honor to announce the launching of the newest International Institute for Private Equity and Investment Banking research and educational initiative: The Warren Buffet Center of

Excellence in Undervalued High Performance Company Investing.

PE funds have outperformed

many other asset classes over three- and five-year horizons, including most

equity indices and alternative assets. The Venture Economics all-PE index, for

instance, has returned 4.9% over the last five years, significantly higher than

US and global equities. PE funds have outperformed

many other asset classes over three- and five-year horizons, including most

equity indices and alternative assets. The Venture Economics all-PE index, for

instance, has returned 4.9% over the last five years, significantly higher than

US and global equities.

PEIB.ORG is working with partners, investors and sponsors in the preparations for the PEIB 500K Competition. For more information please email the PE 500K Competition Organizing Committee at PEIB.ORG is working with partners, investors and sponsors in the preparations for the PEIB 500K Competition. For more information please email the PE 500K Competition Organizing Committee at

|