Private Equity is resilient and nimble and

has demonstrated an ability to withstand shocks. Private equity

investors have come out of the recession with a renewed focus on organic

revenue growth, applying a more entrepreneurial mindset to working with their

portfolio companies.

Private equity firms are operating

today in an increasingly uncertain environment. After the global financial

crisis, the most important lesson learned was: expect the unexpected.

The PE investment model is built on the premise that companies can improve

their performance and better position themselves for long-term success by

aligning the interests of owners and managers and removing the short-term

pressures of public ownership.

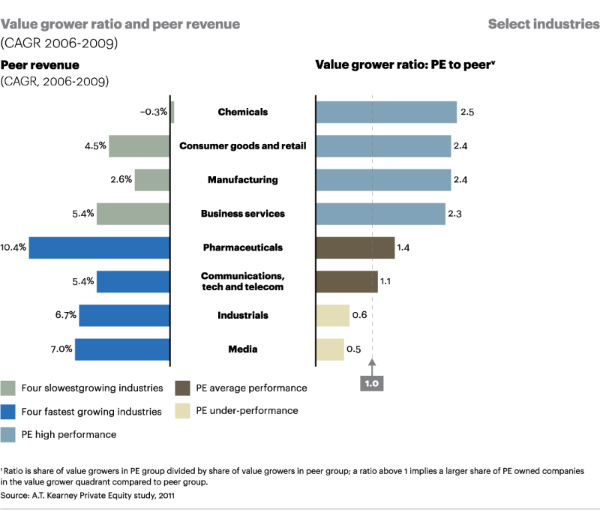

PE Funds for example do very well in low growth industries where a focus on operations and cost, managerial and financial restructuring can have a much bigger impact than in high growth industries as can be seen in the following A.T. Kearney Private Equity study.

Diversify by

geography

PE is also leveraging its

talent and active management expertise to increase its geographic reach into

new markets and capture some of the world's most compelling growth stories.

Diversify the

platform

Firms are increasingly

leveraging their strong brands in PE by expanding into advisory and capital

markets services and becoming multi-asset managers. The result is that large

firms in particular derive less from the traditional leveraged buyout (LBO)

model in terms of returns and capital-raising.

In 2003, buyout assets

accounted for 46% of all private equity capital. By 2012, this had dropped to

38%, and the trend is even more pronounced at the largest firms.

PE

firms are strengthening their asset management capabilities to expand their

franchises. Ventures by firms such as The Carlyle Group and GSO/Blackstone

garner most of the headlines, but it's not just the very largest firms that are

seeking to diversify their income streams.

PE Regulatory Developments

By looking at the U.S. and Global regulatory developments in PE and how PE is helping to create value

more generally we can more clearly see what the future might hold in terms of the global regulatory private equity landscape.